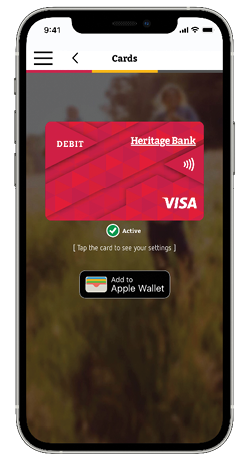

Mobile Banking App

Other ways to bank

Other ways to bank

Our Mobile Banking App gives you a convenient way to bank on the go, pay bills, manage your cards and much more. Download the App today.

Learn more

Grand Alliance Federal Credit Union Online

Whether you're on the go, at the office or at home, Grand Alliance Federal Credit Union Online lets you manage your accounts in one place, at a time that suits you.

Learn more

Banking Branchless

No matter where you’re located, we have banking solutions to help you including 24/7 service, online account opening, Bank@Post and much more.

Learn more

SMS and Email Alerts

Set up SMS or email alerts to receive real-time notifications for key events on your accounts.

Learn more

Phone Banking

Run out of data or don't have a smartphone? You can still check your balances and perform basic transactions from any phone, including landlines, with Grand Alliance Federal Credit Union Access Line.

Learn more

Fast

Fast Secure

Secure